How I Turned Business Failure Into Smart Recovery — My Real Emergency Playbook

When my business collapsed, I didn’t just cut losses—I hunted for every possible return. Panic? Sure. But I knew freezing meant losing everything. So I took control, treating the crisis like a strategy game: where could I recover value, reduce damage, and protect what remained? This is how I rebuilt—not overnight, but step by step, using real methods that actually worked. No hype, just honest moves that maximized returns when it mattered most. I didn’t rely on luck or last-minute miracles. Instead, I focused on practical steps grounded in financial reality, emotional discipline, and strategic thinking. The journey from failure to recovery wasn’t glamorous, but it was necessary—and ultimately empowering.

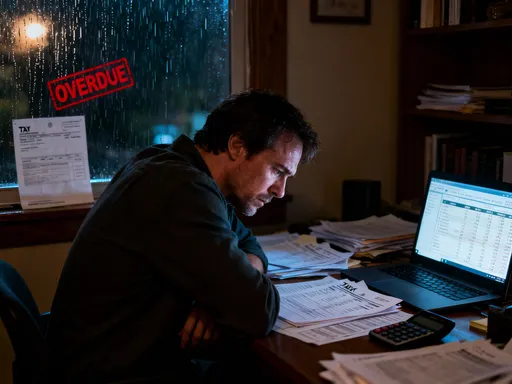

The Moment Everything Crashed — Facing Financial Reality

The phone call came on a Tuesday morning. My largest client was pulling out—effective immediately. They cited internal restructuring, but the message was clear: my company’s primary revenue stream had vanished. Within days, the domino effect began. Vendors called asking for overdue payments. My savings, already stretched thin from months of declining sales, evaporated. The business credit lines I’d counted on were frozen. I sat at my kitchen table, staring at spreadsheets that no longer made sense, feeling the weight of responsibility pressing down like a physical force. This wasn’t just a financial setback; it was a full-scale collapse.

Yet, in the midst of that turmoil, one realization cut through the fog: denial wouldn’t save me. Many entrepreneurs in crisis retreat into hope—waiting for a miracle client, a sudden market turnaround, or an investor who never materializes. I understood that mindset, but I also knew it was dangerous. Avoiding the truth only extends the damage. So I made a decision: I would stop pretending the business could be saved in its current form. Instead, I would assess the situation with cold clarity. That shift—from emotional attachment to objective evaluation—was the first real step toward recovery.

Facing financial reality meant accepting three hard truths. First, revenue wasn’t coming back at the level needed to sustain operations. Second, my fixed costs far exceeded my remaining income. Third, personal finances were now at risk because of blurred boundaries between business and household budgets. Acknowledging these facts didn’t mean surrendering; it meant redirecting energy from preservation to recovery. I stopped asking, “How can I save this business?” and started asking, “What can I still save from it?” That subtle reframe changed everything. It allowed me to move from panic to planning, from reaction to strategy. The emotional toll was real, but I learned that financial recovery begins not with money, but with mindset.

Stop the Bleeding: Emergency Cash Flow Tactics

Once I accepted the situation, the next priority was immediate stabilization. A sinking ship needs patched holes before you plot a new course. In financial terms, that meant stopping the cash outflow. I began by mapping every outgoing dollar—rent, utilities, subscriptions, payroll, insurance, loan payments. I categorized each as either essential or discretionary. The goal wasn’t to cut everything, but to identify what could be paused, reduced, or renegotiated without triggering legal or operational disaster.

One of the first moves was renegotiating with suppliers. I contacted each vendor directly, explained the temporary hardship, and requested extended payment terms. Some said no, but many agreed to 30- or 60-day deferrals. I avoided vague promises and instead offered specific timelines and partial payments to show good faith. This approach preserved relationships while buying time. Similarly, I reviewed all service subscriptions—software platforms, marketing tools, cloud storage—and canceled those not critical to immediate operations. These small savings added up, freeing hundreds of dollars monthly.

Another key step was pausing non-essential growth spending. I had been investing in advertising, hiring contractors, and upgrading office space. All of that stopped. Instead, I focused only on maintaining core functions—client support, order fulfillment, and basic administration. I also suspended owner draws completely. While painful, this preserved the last remnants of operating capital. I treated every dollar as a resource to be conserved, not spent.

Perhaps the most effective tactic was renegotiating lease terms. My office space was under a three-year contract, but I approached the landlord with a transparent proposal: reduce rent temporarily in exchange for staying through the lease term. After negotiations, we agreed on a 40% reduction for three months. This single action saved over $9,000—funds I redirected toward settling priority debts. The lesson was clear: in a crisis, communication and transparency can unlock flexibility you didn’t know existed. Stopping the bleeding wasn’t about drastic cuts alone; it was about smart triage—knowing what to keep, what to pause, and what to let go.

Unlock Hidden Value: What Assets Can Still Work for You?

With cash flow stabilized, the next phase was value recovery. I began a full inventory of all business assets—physical, digital, and intellectual. At first glance, many seemed worthless. Old computers, outdated software licenses, unused office furniture, and incomplete project files didn’t appear to have resale potential. But I approached the audit with a new question: “Could this generate even a small return?” That shift in perspective revealed opportunities I’d overlooked.

Physical assets were the easiest to monetize. I listed used equipment—laptops, printers, desks, and conference room chairs—on online marketplaces. Even items purchased years ago fetched 20% to 40% of their original value. One high-end camera system, originally bought for marketing videos, sold for nearly $1,200 to a local content creator. I didn’t aim for full replacement value; I focused on speed and certainty of sale. By bundling smaller items into lots, I attracted buyers looking for deals and accelerated turnover.

Digital assets required more creativity. I had developed several software tools and templates for internal use—project management checklists, client onboarding workflows, and financial tracking spreadsheets. While not market-ready, they had value. I refined them into simple digital products and listed them on a content marketplace. Within weeks, they generated passive income. One template package alone earned over $800 in the first month. I also reviewed expired contracts and discovered that certain deliverables, though never used, included clauses allowing for reuse or licensing. With legal confirmation, I repurposed one project into a training guide and licensed it to a small firm for a flat fee.

Customer data was off-limits—privacy laws were non-negotiable—but anonymized insights from past campaigns became valuable. I compiled trends, engagement patterns, and segmentation strategies into a market analysis report and sold it as a consultant’s insight package. This wasn’t about exploiting former clients; it was about ethically repurposing knowledge. The total return from asset recovery exceeded $15,000—funds that directly supported debt settlement and personal stability. The takeaway: even in failure, value exists. You just have to look beyond the obvious.

Debt Management: Turning Liabilities into Leverage

Debt is often the heaviest burden after a business collapse. I owed over $42,000 across business loans, credit lines, and unpaid vendor balances. The instinct was to hide, to avoid calls and hope the problem would fade. But I knew that ignoring debt only worsens outcomes—damaging credit, triggering collections, and increasing legal risk. So I chose a different path: proactive engagement. I contacted every creditor, explained my situation honestly, and proposed realistic repayment plans based on actual cash flow.

Communication was key. I didn’t make excuses or overpromise. Instead, I presented a clear picture: income sources, monthly obligations, and available funds. For secured loans, I discussed options like forbearance or temporary interest-only payments. For unsecured debt, I negotiated lump-sum settlements at reduced amounts—typically 40% to 60% of the balance, paid in full upon agreement. Many creditors accepted these offers because they preferred partial recovery over the uncertainty of collections.

I also explored consolidation. One option was a personal balance transfer loan with a lower interest rate, which allowed me to pay off high-cost credit lines. While this shifted debt from business to personal accounts, it reduced monthly payments and simplified management. I avoided predatory lenders and high-fee restructuring services. Instead, I worked directly with financial institutions and used nonprofit credit counseling resources to guide the process.

The most important insight was that not all debt is equal. Some obligations carried reputational weight—like debts to former employees or long-term suppliers. I prioritized these, even if they weren’t the highest interest, because maintaining trust had long-term value. Others, like credit card balances with no personal guarantee, were handled through formal negotiation or, when necessary, legal discharge. The goal wasn’t to eliminate every dollar owed, but to manage liabilities in a way that preserved dignity, credibility, and future opportunity. Debt, when approached strategically, isn’t just a burden—it can become a tool for rebuilding trust and financial stability.

The Exit Multiplier: Maximizing Returns from What’s Left

After stabilizing cash flow, recovering asset value, and restructuring debt, I turned to the final phase: strategic exit. This wasn’t about liquidation at any cost, but about maximizing returns from remaining business elements. I evaluated what was left—the brand name, domain, customer relationships, and residual goodwill—and asked: “Who might find value in this, and how can I present it effectively?”

Timing was critical. Selling too quickly meant accepting fire-sale prices. Waiting too long risked further devaluation. I chose a middle path: preparing the business for transfer over six to eight weeks. I updated financial records, organized client files, and documented processes. I didn’t hide the challenges, but I framed them honestly—showing potential buyers what could be improved, not just what had failed.

I targeted buyers strategically. Rather than listing on public marketplaces, I reached out to competitors and adjacent businesses that might benefit from acquisition. One company expressed interest in the customer list—but only if compliance with data protection rules was guaranteed. I worked with a legal advisor to ensure ethical transfer under opt-in consent rules, and we structured the deal as a service transition, not a data sale. This preserved privacy while generating revenue.

The domain and brand name also held value. Though the business had failed, the name had local recognition and SEO history. I listed it through a domain broker, emphasizing its traffic history and niche relevance. It sold for $3,500—far more than I expected. I also bundled remaining digital assets, support contracts, and software licenses into a single package, marketing it as a “turnkey starter kit” for new entrepreneurs. A young founder purchased it, seeing the value in avoiding setup costs.

The total return from the exit phase exceeded $20,000. This wasn’t a full recovery, but it was significant. The lesson: exit value isn’t determined by what you have, but by how you position it. With preparation, timing, and honesty, even a failed business can yield meaningful returns.

Protecting Future Gains: Building a Resilience Buffer

Recovery doesn’t end when debts are settled or assets are sold. True financial healing requires protection against future shocks. I learned that the hard way—by having no buffer when the crisis hit. This time, I committed to building safeguards. The first step was allocating a portion of recovered funds to an emergency reserve. I set a goal of three to six months of living expenses in a high-yield savings account, accessible but not tempting for daily use.

I also reassessed insurance coverage. I had assumed business insurance would cover revenue loss, but the policy had exclusions I hadn’t fully understood. Now, I prioritized income protection, liability coverage, and cyber insurance with clearer terms. I reviewed policies annually and asked detailed questions—no more assumptions. Insurance isn’t a cost; it’s a stability tool.

Another key change was adopting lean operations in future ventures. I launched a new consulting practice with minimal overhead—no office lease, no full-time staff, no unnecessary tools. I priced services to ensure healthy margins and built in automatic savings from every invoice. I also created a “failure fund”—a dedicated account funded with 10% of profits, earmarked only for crisis response in future businesses. It’s not a sign of pessimism, but of preparedness.

Finally, I separated personal and business finances completely. No more mixing accounts, no more personal guarantees unless absolutely necessary. I used dedicated banking, clear bookkeeping, and regular financial reviews. This discipline reduced risk and increased clarity. The goal wasn’t just to survive the next challenge, but to face it from a position of strength.

From Collapse to Clarity: Lessons That Last Beyond Money

The financial recovery was important, but the deeper transformation was personal. Business failure didn’t just cost me money—it reshaped my thinking. I emerged with sharper instincts, greater discipline, and a deeper respect for risk. I no longer equate effort with success, nor failure with worth. I learned that resilience isn’t about avoiding collapse, but about how you respond when it happens.

One lasting change was in decision-making. I used to act quickly, trusting intuition. Now, I balance instinct with analysis—asking not just “Can I do this?” but “Can I sustain it?” I build exit ramps into every plan, knowing that flexibility is a form of strength. I also prioritize transparency—in finances, in partnerships, in communication. Secrets and delays only magnify problems.

Emotionally, I’ve made peace with the past. I don’t hide the failure; I share it as a lesson. That openness has built trust in new ventures and strengthened personal relationships. I’ve also developed a healthier relationship with risk. I’m not afraid to start again, but I do so with eyes open—prepared, protected, and purposeful.

Maximizing returns wasn’t just about recouping losses. It was about reclaiming control. It was about proving that even in the wake of collapse, smart, deliberate action can create value, restore stability, and lay the foundation for a more resilient future. The money mattered, but the mindset mattered more. And that, more than any dollar recovered, is the real win.